Introduction – AI Tools For Trading Stocks

In an era where digital technology reshapes every corner of our lives, the financial markets have not remained untouched. Artificial Intelligence (AI) has progressively infiltrated this space, transforming traditional trading methods with unprecedented computational prowess. This transition isn’t just about automation or speed; it’s about the profound capability of AI to analyze, predict, and execute trades with an efficiency and accuracy that humans cannot match.

Overview of AI in Stock Trading

The infusion of AI in stock trading isn’t merely a trend; it’s a revolution that redefines market dynamics. Traditional trading relies on human analysis and intuition, often limited by emotional bias and the physical inability to process vast amounts of data swiftly. AI sidesteps these limitations through algorithms that can digest and analyze data at a scale unthinkable just a decade ago. More importantly, AI’s ability to learn and adapt from data continuously helps in refining strategies based on market behavior changes, which is crucial in the volatile trading environment.

The Impact of AI on Stock Trading

The impact of AI on stock trading is multi-dimensional. Firstly, it democratizes trading. Sophisticated tools once reserved for institutional traders with deep pockets are now accessible to a broader audience, including retail investors and small firms. This accessibility means a more level playing field where informed decisions are the norm, not the privilege. Secondly, AI-driven tools help in mitigating risk. By forecasting potential market downturns and providing real-time insights, these tools enable traders to make more informed decisions, often saving them from substantial financial losses.

Yet, the conversation around AI in stock trading often circles back to the fear of the unknown—job displacement, over-reliance on technology, and potential market manipulation. While these concerns are valid, they often overshadow the critical benefits and innovations AI brings to the table. As we delve deeper into the top AI tools for stock trading, we aim to highlight not only their technical capabilities but also how they contribute to a more robust, efficient, and transparent market.

In this guide, we explore the top ten AI trading tools that are shaping the future of stock trading. These tools not only offer advanced analytical capabilities but also ensure that every trader, regardless of their technical background, can harness the power of AI to optimize their trading strategies and achieve better outcomes.

Understanding AI Trading Tools

As the digital landscape evolves, the integration of Artificial Intelligence (AI) into stock trading has become a focal point for both technologists and traders. AI trading tools are not just novel gadgets; they represent a significant shift in how financial markets operate, bringing a higher level of precision and efficiency to stock trading strategies.

What is AI Stock Trading?

AI stock trading involves using machine learning models and algorithms to predict market movements, execute trades, and manage portfolios with minimal human intervention. Unlike traditional methods that depend heavily on human analysis, AI tools can process and analyze large datasets in real time, uncovering opportunities and risks by identifying patterns that are often invisible to the human eye.

Benefits of Using AI for Stock Trading

AI trading tools harness several advanced technologies to revolutionize how traders interact with financial markets. These benefits, as outlined in the article by Saurav L. Chaudhari on LinkedIn, underscore the transformative nature of AI in this field.

Revolutionizing Data Analysis

AI algorithms can analyze vast amounts of data—from historical price movements and financial reports to news articles and social media sentiments. This comprehensive data analysis capacity enables AI to anticipate market trends and movements with a high degree of accuracy. Techniques like data preprocessing and feature engineering further enhance the predictive capabilities of AI models, making them invaluable assets for traders who need to stay ahead of market curves.

Sophisticated Algorithmic Paradigms

The application of sophisticated machine learning techniques such as decision trees, support vector machines, and neural networks allows AI tools to perform complex classification and regression tasks reliably. Moreover, reinforcement learning enables these models to adapt and optimize their strategies in real-time based on market behavior, offering a dynamic tool that evolves with the market.

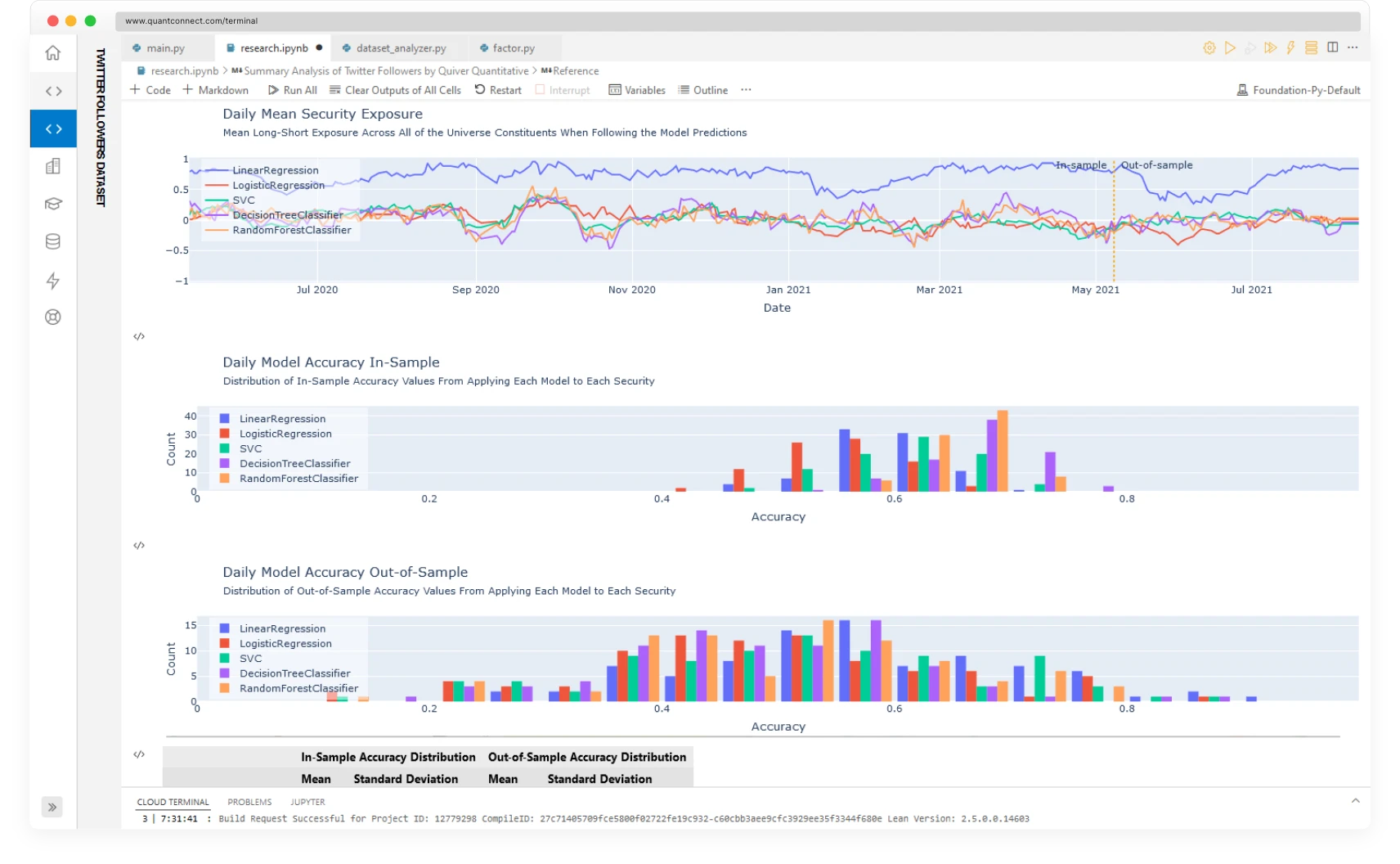

In-Depth Testing and Validation

Before being deployed in live environments, AI algorithms undergo rigorous backtesting using historical data to evaluate their effectiveness under various market conditions. This testing ensures that the AI strategies are robust and can handle unexpected market volatility. Furthermore, real-time simulation techniques allow for the fine-tuning of these strategies in simulated environments that mimic current market conditions, ensuring that they perform optimally when deployed.

Strategic Advantages

AI-driven tools automate many of the labor-intensive tasks associated with traditional trading, such as data collection and analysis, allowing traders to focus on strategic decision-making. The ability of AI to detect subtle market signals and patterns gives traders foresight, enabling them to capitalize on emerging opportunities swiftly and efficiently. This automation not only saves time but also significantly reduces operational costs.

Synergy of Human Judgment and AI Precision

Perhaps one of the most significant advantages of AI in stock trading is the potential synergy between human intuitive skills and AI’s analytical prowess. This partnership allows traders to combine their market knowledge and intuition with comprehensive, data-driven insights provided by AI, leading to well-rounded and strategically sound trading decisions.

In conclusion, AI trading tools embody a significant technological advancement in the financial sector, offering unprecedented insights and capabilities that are reshaping the landscape of stock trading. The adoption of AI not only enhances operational efficiency but also equips traders with the tools necessary for navigating the complexities of modern financial markets.

Criteria for Evaluating AI Trading Tools

Selecting the right AI trading tool is crucial for achieving optimal trading performance. Investors, whether seasoned or novice, must consider a range of criteria to ensure the tool they choose aligns with their trading strategy and goals. Here are the essential factors to evaluate when choosing an AI trading tool, designed to guide both individual investors and financial managers in making informed decisions.

Accuracy of Predictions

The primary value of an AI trading tool lies in its ability to predict market movements accurately. The precision of these predictions directly impacts the profitability and risk level of trading activities.

- Historical Accuracy: Look for tools that demonstrate high accuracy rates in historical back-testing scenarios.

- Consistency Across Market Conditions: Evaluate whether the tool maintains accuracy during different market conditions—bullish, bearish, and volatile periods.

Ease of Use

The complexity of AI trading software can be daunting. A tool that balances advanced capabilities with user-friendly design will enable traders to utilize its features fully without a steep learning curve.

- Intuitive Interface: Users should be able to navigate the tool’s features easily and configure settings without constant reference to help documents.

- Accessibility: Check for accessibility features that cater to all users, including those with disabilities, ensuring everyone can use the software effectively.

Integration with Existing Platforms

For many traders, the ability to integrate new tools with their existing trading platforms is vital. Seamless integration ensures that they can add AI capabilities without disrupting their established trading operations.

- Compatibility: Ensure the AI tool is compatible with major trading platforms and can be easily incorporated into the existing tech stack.

- API Access: Availability of robust API support for custom integration needs is a plus, allowing for a more tailored trading experience.

Cost-Effectiveness

Investing in AI trading tools should also make economic sense. Evaluate the cost relative to the features and benefits provided.

- Subscription Models: Consider whether the pricing structure aligns with your trading volume and frequency.

- ROI Potential: Assess the potential return on investment by considering the tool’s ability to increase profitability through better decision-making.

Support and Updates

The trading environment is dynamic, and AI tools need regular updates to stay effective. Continuous support is also crucial for addressing any issues that may arise.

- Regular Updates: The tool should receive regular updates to keep its algorithms and data feeds current with market conditions.

- Customer Support: Look for tools that offer robust customer support, including tutorials, FAQs, and responsive customer service teams.

Security Features

Given the financial stakes involved, the security of AI trading tools is non-negotiable. Ensuring that your data and transactions are protected should be a top priority.

- Data Encryption: Ensure that the tool uses strong encryption protocols to secure user data.

- Compliance and Certification: Verify that the tool meets relevant regulatory and compliance standards to avoid legal pitfalls.

Top 10 AI Tools for Trading Stocks

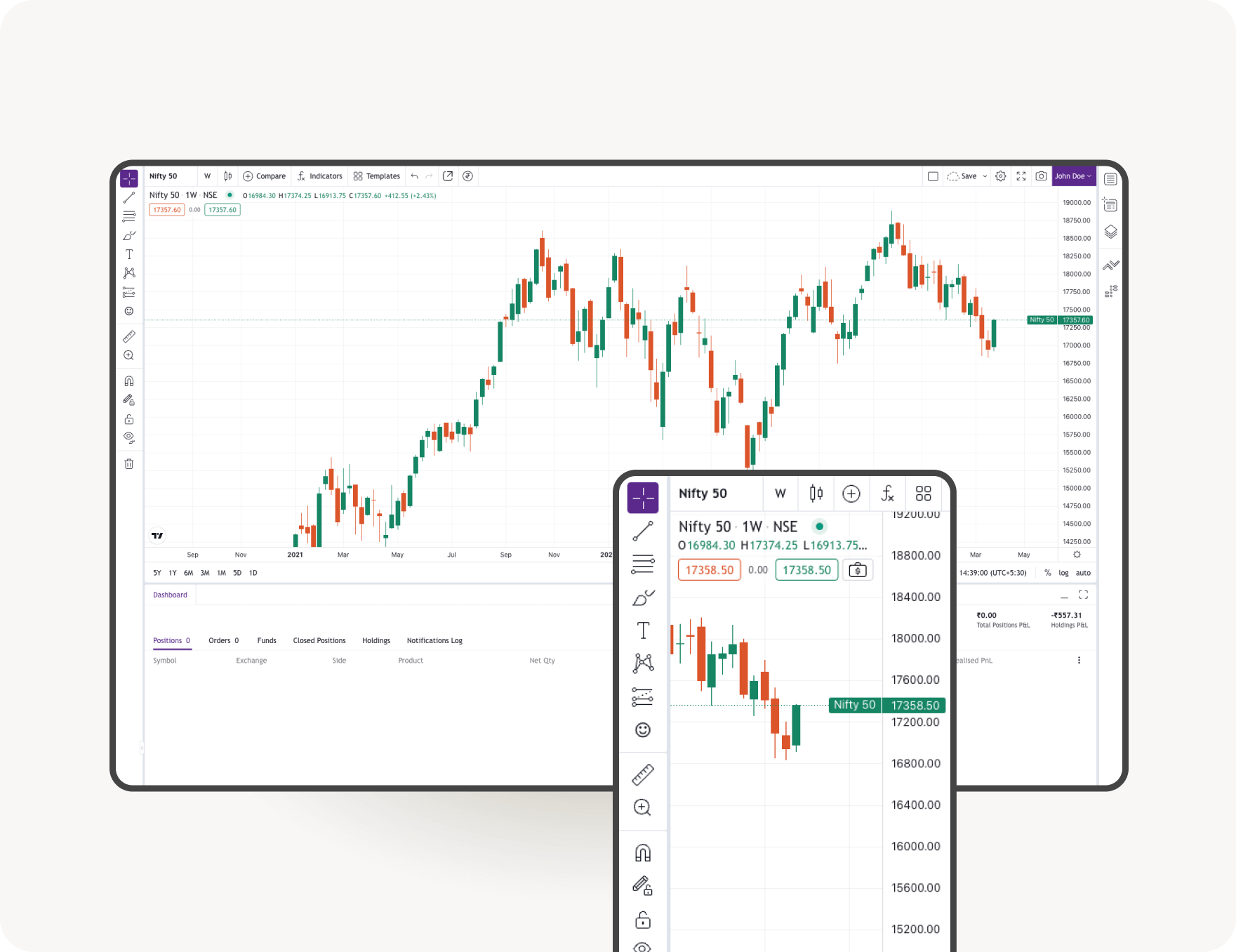

Navigating the complex world of stock trading with the assistance of AI has become more accessible due to a variety of sophisticated tools designed to enhance investment strategies. Below, we explore the top 10 AI trading tools that are shaping the future of trading, offering unique perspectives and functionalities seldom discussed in mainstream analyses. Each tool brings something distinct to the table, from advanced algorithmic analytics to user-friendly interfaces that democratize financial technology.

1. QuantConnect

QuantConnect offers a robust algorithmic trading platform that allows users to design, backtest, and deploy their trading strategies across multiple assets. It stands out by providing an open-source framework, enabling a collaborative approach to developing trading algorithms.

- Unique Feature: Community-based algorithm examples that users can adapt for their own strategies.

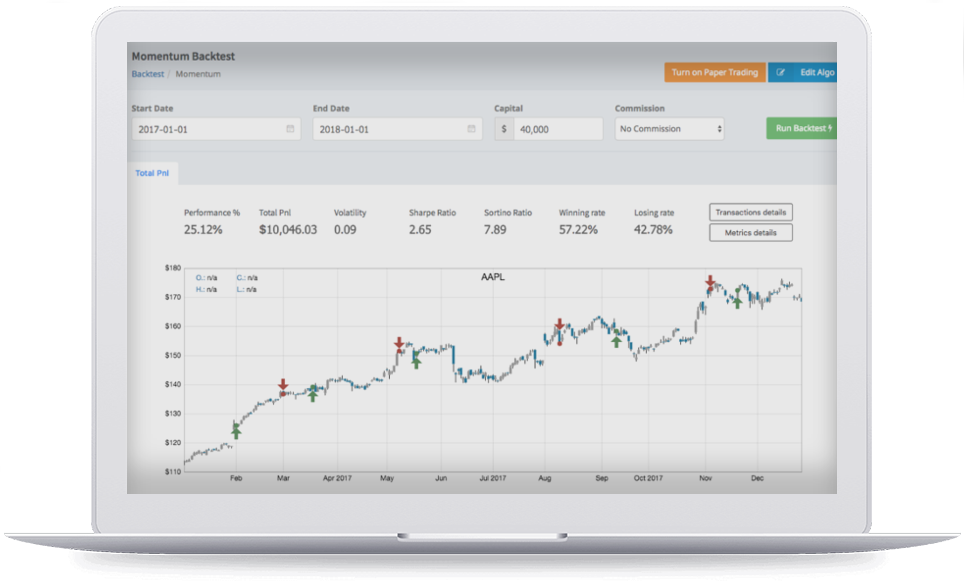

2. Algoriz

Algoriz is an AI-powered platform that allows traders to construct algorithms using both code and natural language processing. This tool is particularly accessible for those who may not have a deep programming background but possess strong trading ideas.

- Unique Feature: Natural language processing to write scripts, making algorithm design more intuitive.

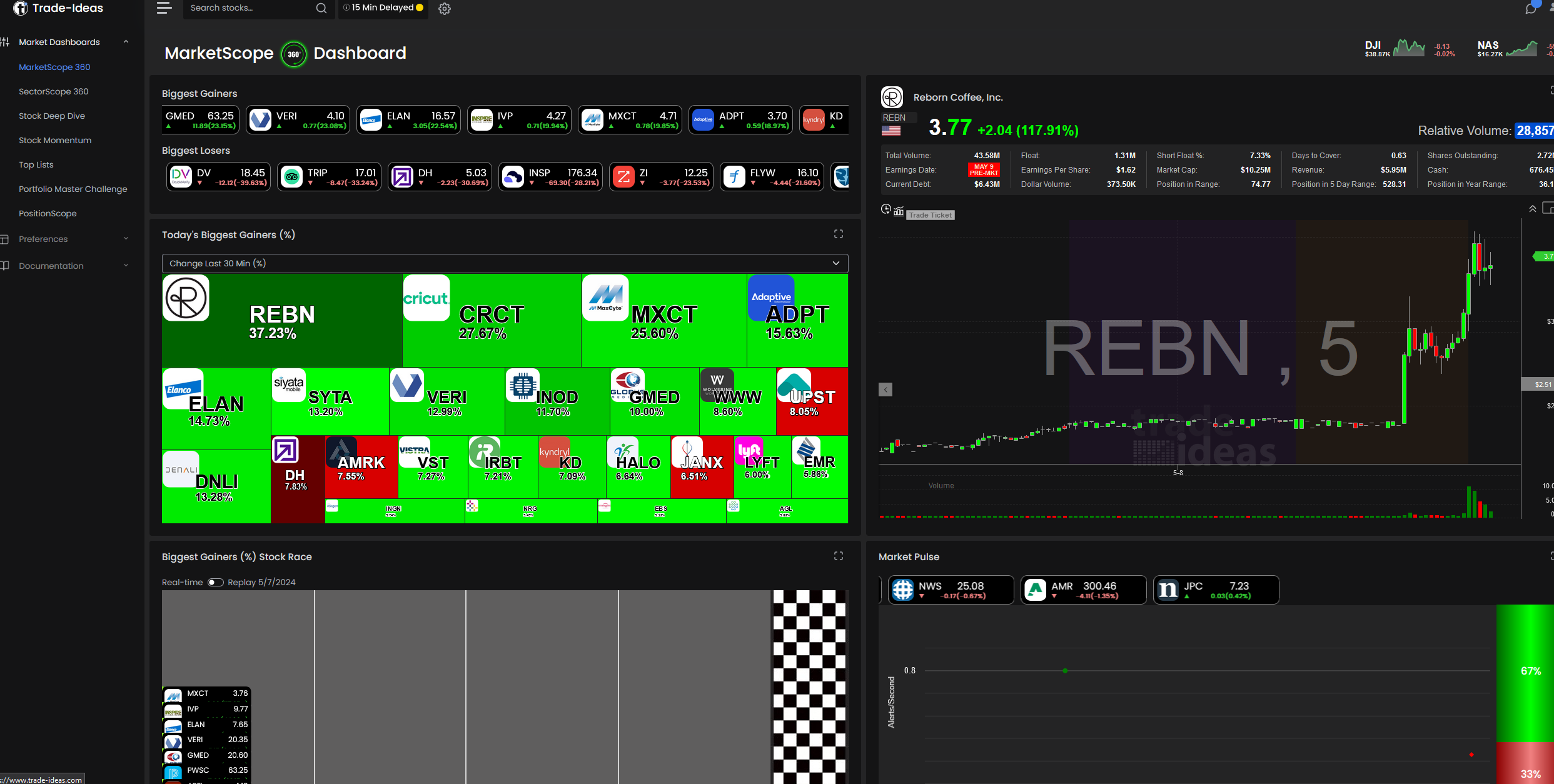

3. Trade Ideas

Trade Ideas utilizes AI to scan the stock market in real time and identify high probability trading opportunities. Its flagship feature, Holly, is an AI virtual trading assistant that suggests trades, optimized for both entry and exit points.

- Unique Feature: Holly the AI assistant, which conducts real-time market simulations overnight to present fresh trading strategies each morning.

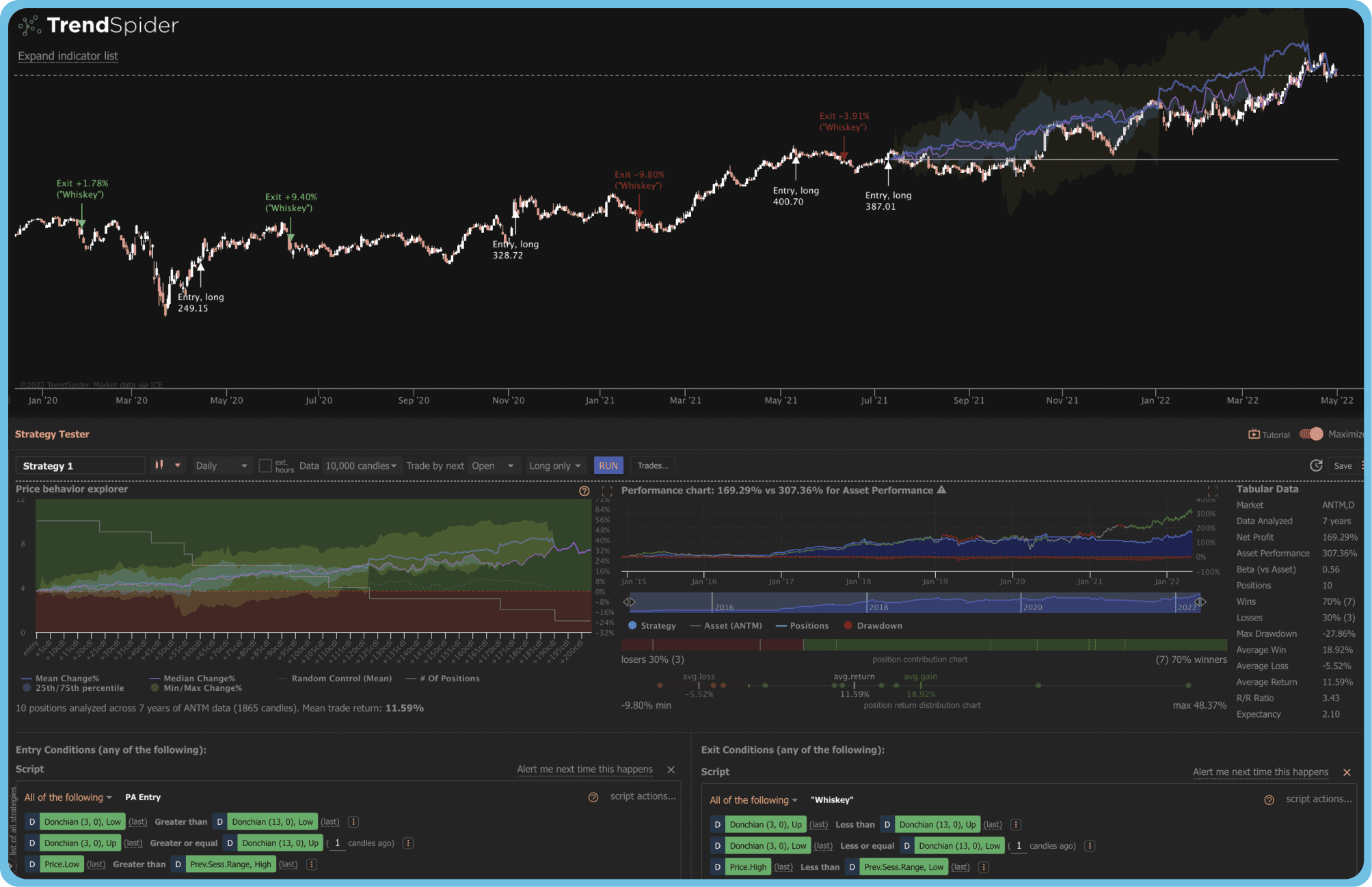

4. TrendSpider

TrendSpider is designed for technical traders who require sophisticated charting tools combined with AI-driven insights. It automates the analysis of technical indicators and patterns, saving time and enhancing decision accuracy.

- Unique Feature: Automated technical analysis tools that can dynamically adjust to market conditions.

5. Upstox Algo Lab

Upstox Algo Lab integrates with AmiBroker AFL to help traders execute complex trading strategies that require real-time data analysis. It’s designed for traders who need to quickly adapt strategies based on changing market data.

- Unique Feature: Seamless integration with AmiBroker, allowing for sophisticated strategy deployment on a user-friendly platform.

6. EquBot

EquBot employs AI to process financial news, market data, and social media in real-time, offering investment insights and portfolio recommendations. It uses IBM Watson to process vast amounts of data for comprehensive market analysis.

- Unique Feature: Integration of IBM Watson to enhance data analysis capabilities far beyond typical market scopes.

7. Kavout

Kavout uses machine learning and data science to identify short and long-term investment opportunities in the stock market. Its ‘K Score’ feature ranks stocks based on their potential to outperform.

- Unique Feature: The proprietary K Score system that evaluates stocks using machine learning for predictive accuracy.

8. Sentient Trader

Sentient Trader is unique for an Ai Tools that is For Trading Stocks, in that it trades based on cyclic theories and provides predictive market analysis. This tool is ideal for traders who follow Hurst Cycles in their trading decisions.

- Unique Feature: Market analysis based on the cyclic theory of Hurst Cycles, offering a unique approach to timing trades.

9. Black Box Stocks

Black Box Stocks offers a real-time algorithmic trading tool that provides alerts on unusually high trading activity and potential stock movements before they happen.

- Unique Feature: Alerts on high-impact movements and anomalies in stock prices not readily observable.

10. Aiera

Aiera is an advanced forecasting tool that uses deep learning to provide earnings and performance forecasts. This platform excels in monitoring and interpreting complex financial events and analyst sentiments.

- Unique Feature: Deep learning models that predict financial events and earnings with a high level of accuracy.

These AI tools represent the forefront of trading technology, each introducing a unique angle to traditional stock trading approaches. By leveraging these tools, traders can enhance their decision-making process, optimize their trading strategies, and gain a competitive edge in the fast-paced world of stock trading.

Comparative Analysis of the Top AI Trading Tools

Choosing the right AI trading tool can be daunting given the plethora of options available. To assist in this decision-making process, a comparative analysis of the top AI trading tools is essential, highlighting key differentiators and common functionalities that can influence a trader’s choice based on their specific needs.

Comparing Features

Each AI trading tool offers a unique set of features designed to cater to different trading styles and preferences. By comparing these features, traders can identify which tool best matches their trading strategy:

- Real-Time Analytics: Tools like Trade Ideas and Black Box Stocks excel in providing real-time market analytics, which are crucial for day traders who need to make quick decisions based on the latest market movements.

- Technical Analysis Automation: TrendSpider stands out for its automated technical analysis capabilities, ideal for traders who rely heavily on technical indicators and charts.

- Predictive Accuracy: Kavout and Aiera provide high predictive accuracy with their proprietary AI algorithms, appealing to traders who focus on mid to long-term investment opportunities.

User Feedback and Ratings

Understanding how existing users rate and perceive these tools can provide insights into their effectiveness and reliability:

- User Satisfaction: Platforms like QuantConnect and Algoriz often receive high marks for user satisfaction due to their community-driven approach and flexibility in strategy development.

- Ease of Use: Upstox Algo Lab and TrendSpider are frequently praised for their user-friendly interfaces, which make them accessible even to those with limited technical knowledge.

Strategic Advantages

The strategic advantages of each tool can help traders gain an edge in the market:

- Data Handling Capabilities: EquBot, with its IBM Watson integration, handles vast datasets efficiently, providing comprehensive market insights that are hard to match.

- Adaptability to Market Conditions: Tools like Sentient Trader that focus on cyclic theories offer a unique perspective that can be particularly advantageous in volatile markets.

Future Trends in AI Trading Tools

The landscape of AI in stock trading is rapidly evolving, driven by technological advancements and increasing market acceptance. As we look to the future, several key trends are set to shape the next generation of AI trading tools, offering both opportunities and challenges for traders and developers alike. Understanding these trends is crucial for anyone looking to stay ahead in the dynamic world of stock trading.

Advancements in AI Technology

AI technology is continuously improving, with new algorithms and learning models emerging that enhance predictive accuracy and decision-making capabilities. Future AI trading tools are likely to incorporate more advanced forms of machine learning, such as deep reinforcement learning, which allows systems to learn and optimize their strategies in dynamically changing environments.

- Integration of Quantum Computing: The potential integration of quantum computing into AI trading tools could revolutionize their processing capabilities, allowing for the analysis of vast datasets at speeds previously unimaginable. This could drastically reduce the time needed for complex computations, leading to more timely and accurate trading decisions.

Regulatory Considerations in AI Tools for Trading Stocks

As AI tools become more prevalent in trading, regulatory bodies are increasingly focusing on how these technologies are deployed and managed. Ensuring compliance with international financial regulations will become more complex but also more critical.

- Transparency and Ethics: There will be a growing demand for greater transparency in how AI tools make trading decisions. This includes clear explanations of the algorithms’ decision-making processes and the data they use, which is essential for maintaining trust and adherence to ethical standards.

AI’s Role in Personalized Trading Strategies

The customization of AI trading strategies to individual investor profiles is an emerging trend that could see significant growth. AI systems could be designed to align with specific risk tolerances, investment goals, and personal trading preferences, providing a more tailored trading experience.

- Predictive Personalization: AI could analyze an individual’s past trading behavior to predict future preferences and recommend strategies that align more closely with their historical tendencies and outcomes.

Collaboration Between AI and Human Traders

The symbiotic relationship between AI tools and human traders will continue to deepen. Future AI systems are expected to become more adept at augmenting human decision-making rather than replacing it, leveraging the strengths of both human insight and algorithmic precision.

- Augmented Trading Floors: Imagine a trading floor where AI and human traders work seamlessly together, with AI providing real-time data and predictive analytics while humans focus on strategic decision-making and risk assessment.

Conclusion

As we explore the transformative role of AI in stock trading, it becomes clear that these tools are not just facilitating transactions but revolutionizing how we approach the markets. The insights derived from AI are reshaping strategies, enhancing decision-making processes, and leveling the playing field for all types of investors. From predictive analytics to real-time data processing, AI tools empower traders to navigate the complexities of the stock market with unprecedented precision and efficiency.

Saurav L. Chaudhari in his LinkedIn article on the benefits of using AI for stock trading encapsulates this shift, stating, ‘AI-driven automation streamlines research processes, enabling traders to focus on strategic decisions. AI’s ability to detect subtle market patterns and sentiments provides foresight to capitalize on emerging opportunities, significantly reducing operational costs while enhancing market insight.’ This observation highlights the dual benefit of AI: operational efficiency paired with strategic depth.

The exploration of the top ten AI trading tools in trading stocks provided here serves as a guide to understanding the diverse capabilities and specialties each tool offers. Whether you are a day trader looking for real-time analytics or a long-term investor interested in predictive personalization, there is an AI tool designed to meet your specific trading needs. The comparative analysis and future trends discussed not only illuminate the current state of AI in trading but also forecast a dynamic future where AI and human expertise merge to create even more sophisticated trading mechanisms.

In conclusion, as AI continues to evolve and integrate deeper into the trading landscape, it invites traders to reimagine their strategies and embrace the new possibilities it brings. The synergy of human judgment and AI precision creates a potent mix that enhances not just the speed and efficiency of trading operations but also the quality of decisions made. By leveraging the insights and functionalities of advanced AI trading tools, traders can position themselves advantageously in the rapidly changing stock market, turning volatility and complexity into profitable opportunities.

As we move forward, embracing these advancements will not only be beneficial but essential for those looking to thrive in the future of stock trading.

For those exploring the entrepreneurial side of AI, our feature on How to Make Money with AI explores various strategies to monetize AI technologies. Whether you’re a startup owner, a freelancer, or an established business, this guide offers valuable insights into turning AI into a profitable venture.